Cost of Liquidity – Central Bank Liquidity of Eurozone Banks

Peter Barkow | Sign Up For Our Newsletters >> HERE

– German Banks Currently With Excess Liquidity of €380bn

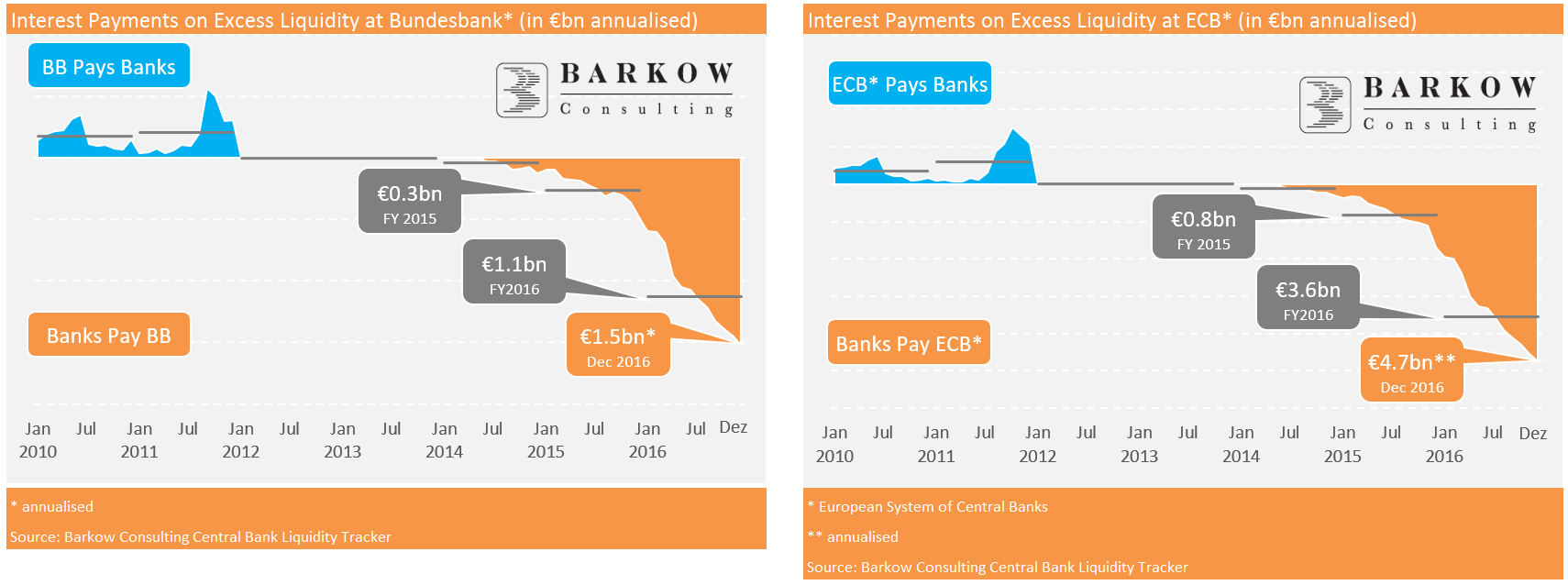

– Related Central Bank Charges Reach €1.5bn in 2016

– …equating to >5% of Bank Profits

Excess Liquitity at Central Banks

With the advent of negative interest rates much talk about liquidity and funding costs for banks has started throughout the year.

One element that has created a lot of interest recently, is the cost burden of excess liqudity from commercial banks parked with central banks. We have now given it a shot and quantified the related cost impact for banks and have created a financial model, called Barkow Consulting Central Bank Liquidity Tracker. Our model monitors excess liquidity volumes and interest rate payments for the banking sector in Germany and the Eurozone.

We are, of course, aware of the fact, that looking at the cost of excess liquidity considers only one of many interactions between commercial and central banks. There are, on the other hand, numerous ways where banks currently benefit from ECB measures with low funding costs.

Nevertheless, we also consider it crucial to finally put numbers behind the current cost of excess liquidity discussion

Germany: Excess Liquidity Costs Exceed 5% of Pretax Profits

German banks have currently parked €380bn with Deutsche Bundesbank and will pay interest charges of €1.1bn in FY2016. This equates to 4.3% of German banks pre tax profit for FY2015. As can be seen in the chart below, liquidity costs are increasing strongly at present. Thus, we calculate an even higher annualised charge of €1.5bn for December 2016, which is already 5.7% of banks‘ pre tax profit for 2015.

At the same time, Eurozone banks currrently hold €1.2tn of excess liquidity with their respective central banks generating liqudity costs of €3.6bn for FY2016 or €4.7bn for December 2016 (annualised)