German Banking KPIs by Sector

Peter Barkow – For Free Updates on Banks & FinTech Sign Up >> HERE

Savings & Cooperative Banks: Who Pays for Higher Costs?

We have analysed German banking sector by seven KPIs* and draw the following conclusions:

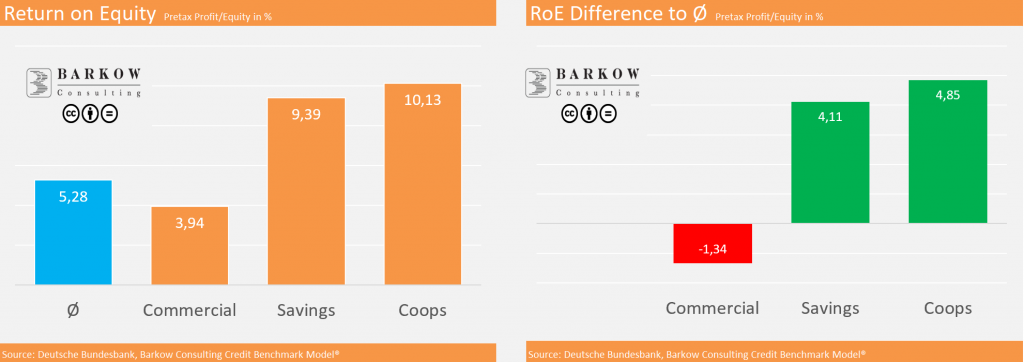

- Pre tax RoEs of cooperative and savings banks are more than twice as high than those of private banks

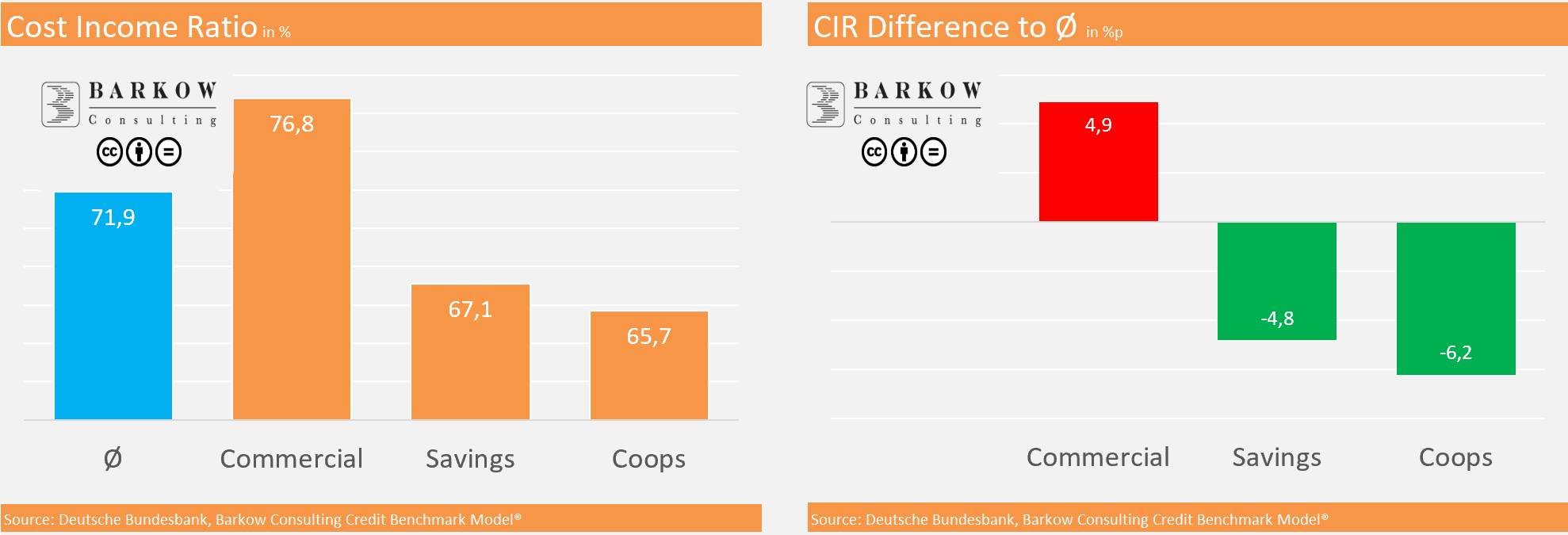

- Cost Income Ratios of of cooperative and savings banks are better too

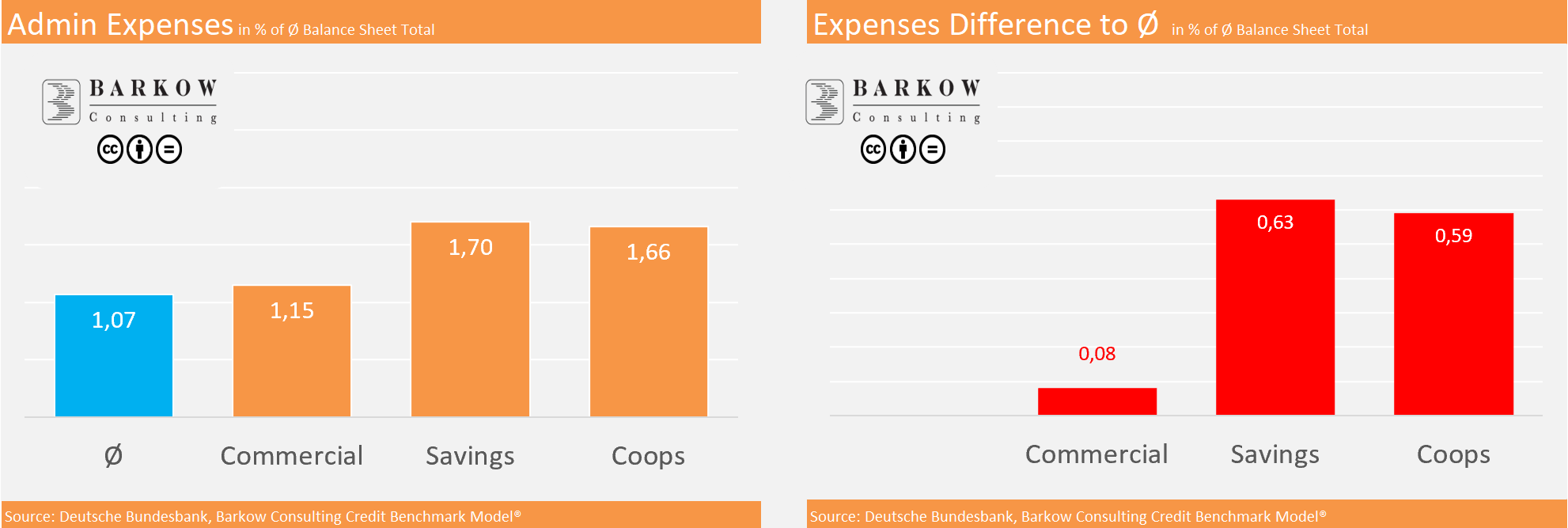

- Despite much higher admin expenses of cooperative and savings banks

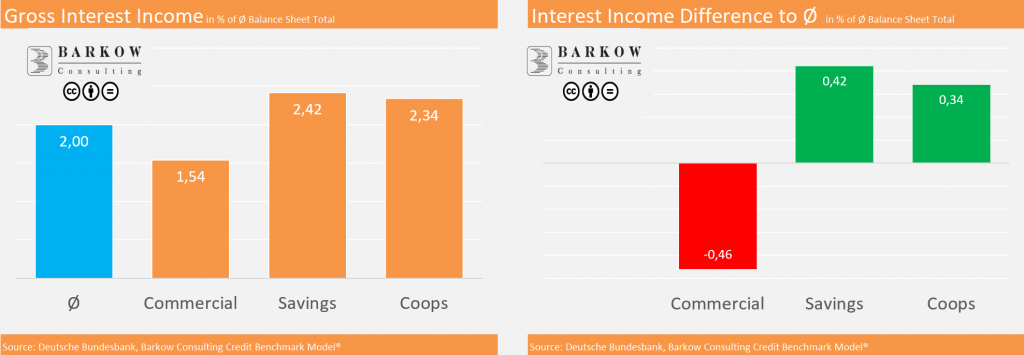

- Gross interest income of cooperative and savings banks is, however, much higher compared to commercial banks

- Whereas, interest expenses of cooperative and savings banks are only slightly lower compared to commercial banks

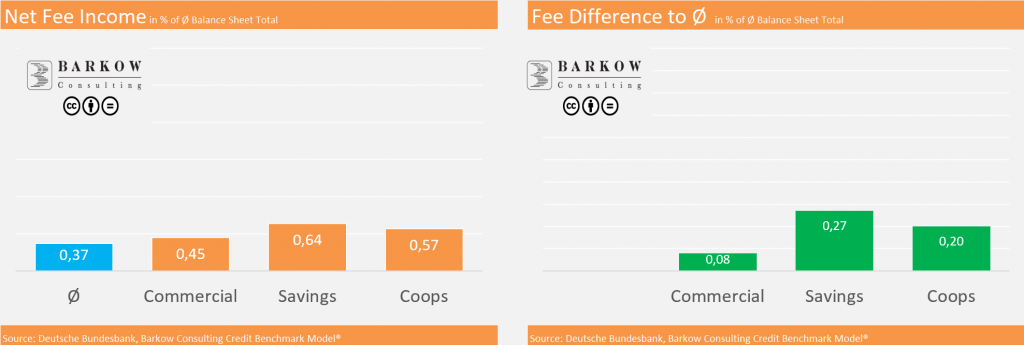

- Net fee income of cooperative and savings banks, again, is significantly higher compared to commercial banks

- Lastly, risk expenses of cooperative and savings banks are roughly in line with commercial banks (and rock bottom generally)