Big Bonus – Career Counseling by the Regulator

The European Banking Authority (EBA) has just provided us with data about High Earners in European banking for 2015. A High Earner according to EBA is a banker making at least €1m per year. It is irrespective, whether compensation comes in the form of base salary or bonus, is deferred, in stock or cash.

The data set was so appealing, we had to cut our analytical teeth into it:

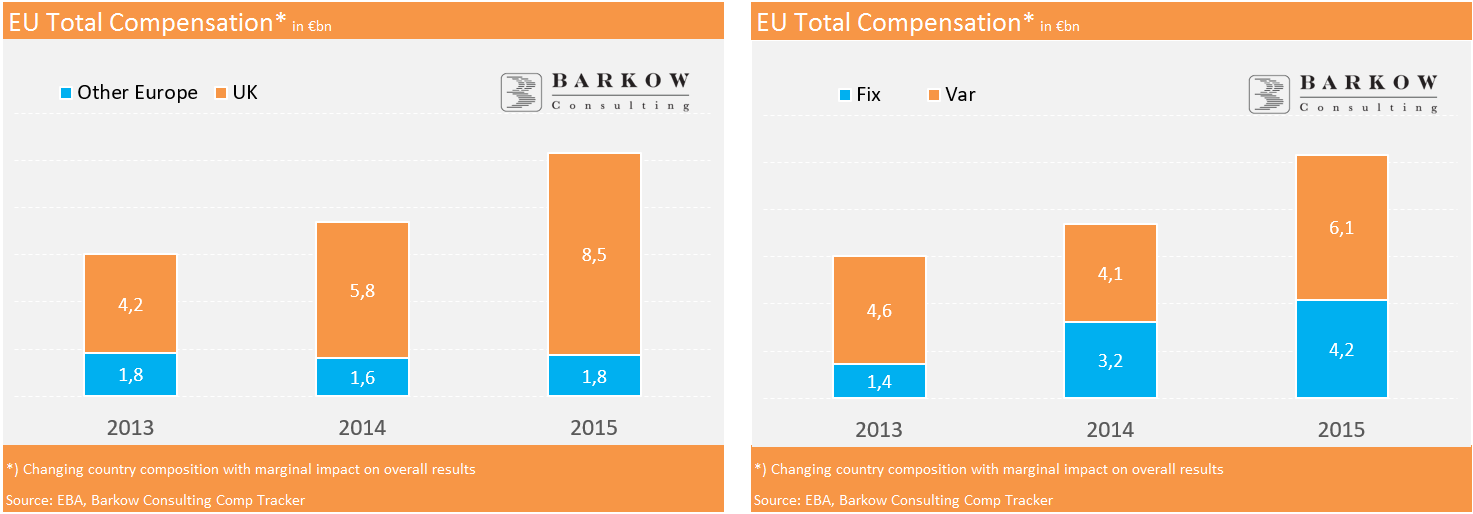

- Total Compensation of €10.3bn

EBA counts 5.142 High Earners for 2015 (up 33% yoy), which made a combined €10.3bn (up 40% yoy). A large part of the swings is driven by the appreciation of the pound, which both increased the number of High Earners as well as average compensation. - Europe ex UK Little Changed on 2013

As EBA did not single out the currency impact described above, we have looked at UK and the rest of Europe separately. The UK makes up 83% of total comp and reported an above average salaery increase of 49% yoy, while High Earners increased by 41% yoy.

Consequently, Rest of Europe was little changed. Total comp was up 8% yoy and even unchanged on 2013. Although the number of High Earners was up 7% yoy, it was even down 8% on 2013. - Base Salary Is Rising Strongly

Another interesting fact is, that base salaries have risen strongly in all regions and also per head. It almost doubled yoy in 2014 already, probably in anticipation of tougher European bonus rules. - You Can Still Make Almost €34m in Banking!

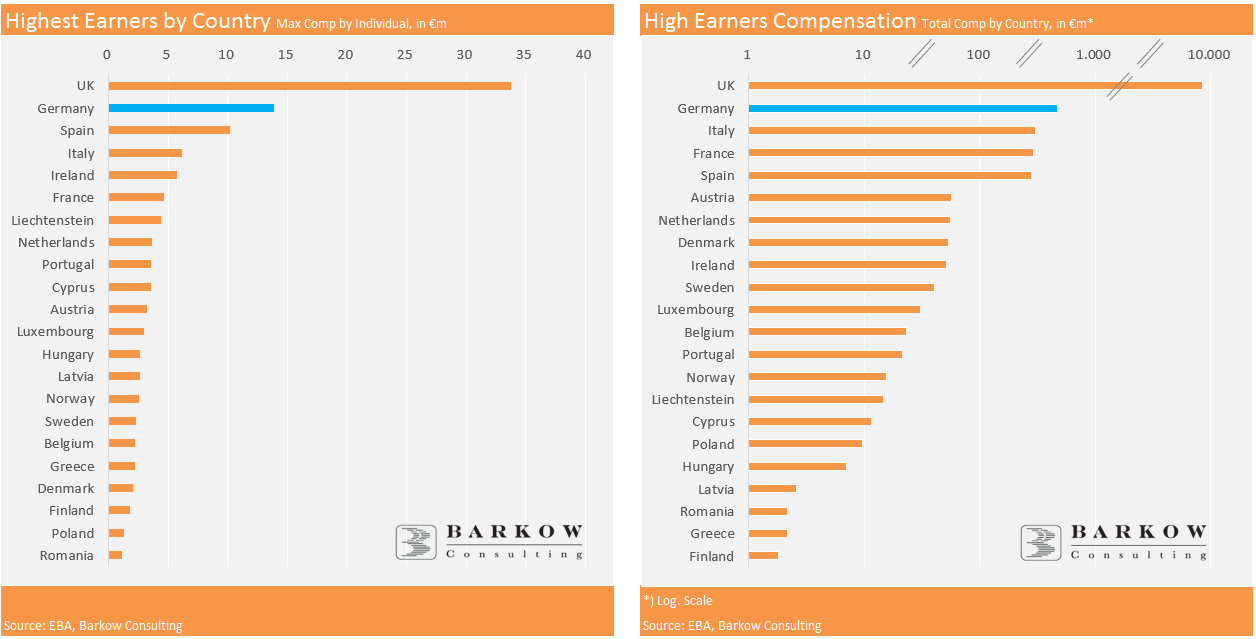

We were intrigued by the granularity of EBA data. We found the Highest Earners bracket of particular fascination and especially motivating for people considering a career in banking. The Highest Earner in the UK was awarded a total comp of €33.8m on a base salary of €0.2m. It seems that no bonus cap was applied here. We consider this a lot of money and think that most FinTech startups will have to go a long way before getting there. Even some FinTech founders might struggle to get to these kind of annual income figures.

One further element of career counseling;

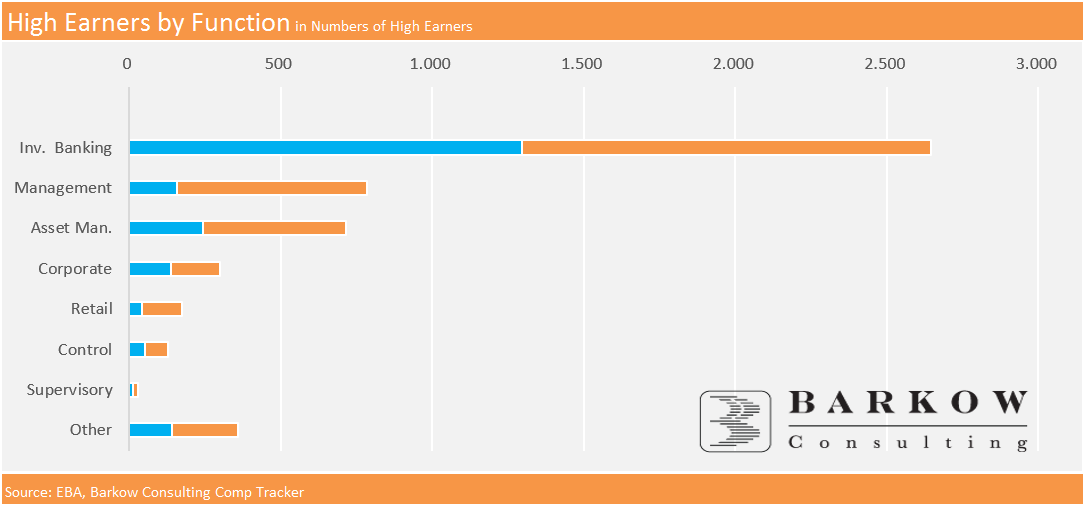

Asset Management (supposedly to read as Hedge Funds) is apparently the most attractive spot in UK banking in terms of maximum comp at present. It dominates the UK income bracket above €20m. However, there are not a lot of jobs available. The total number of positions was limited to six in 2015… - Investment Banking the Safe Bet For a €1m+ Job?

Investment Banking is home to most European and especially UK High Earners, with 51% of top producers working in the segment. Management Functions and Asset Management follow behind with 15% and 14% respectively. - Germany a Good Spot for High Earners Too

The Highest Earner in Germany still made a decent €13.9m in 2015, which is the highest income outside of the UK. The runner up arrived at total comp of €7.6m. Interestingly Germany’s Highest Earner was qualified as staff, whereas the runner up was grouped into management.

Germany is also the country with the second highest share of High Earner comp (a total of €471m or 4.6% of European total), probably unsurprising given the size of its economy.