Crowding Out – Status Quo of CrowdInvesting for Startups

Peter Barkow – For Free Updates on Startups, Venture Capital and FinTech Sign Up >> HERE

What Happened in the Last Two Years

It’s been almost two years since we last looked at Startup CrowdInvesting in Germany.

After a number of high profile defaults in recent time, we thought it appropriate to reconsider, where we stand:

- Investment volumes are moving sideways at best, FY2016 was actually down 4% to 5% yoy

- Q1 2017 started off slowly with investments of only around €3m

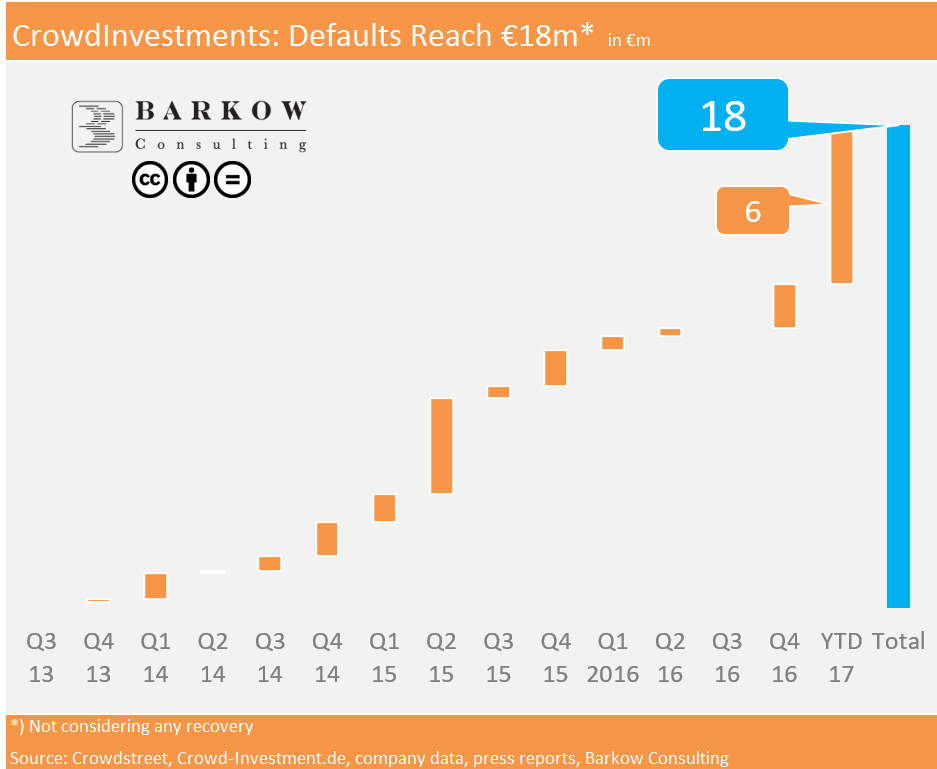

- Defaults are ballooning reaching a total of €18m on our estimate:

- This is 25% of total investments to date

- …or 38% considering a 18 months lag

- Q1 2017 defaults reached at least €5m, a new record high by a wide margin

- There have been few exits to date

- Most of which mandatory buy out offers to the crowd

- None was a killer exit (5x or better 10x invested volume)

Still Waiting For a Killer Exit

Each asset class has to generate risk adjusted returns in the long run in order to remain relevant. Startup CrowdInvesting is no exception to this.

Ballooning defaults are not nice, but still wihtin in a normal range for very early stage startup investing on our watch.

On a more negative stance, the clock continues to tick for an asset class validating big and very successfull exit.