German VC Gap: New Record High!

Peter Barkow – For Free Corporate Finance Updates Sign Up >> HERE

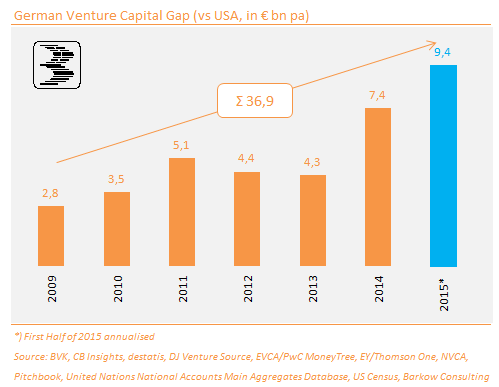

We have updated our Venture Capital (VC) gap analysis for Germany vs the US and included H1 2015 figures.

Main Findings:

– German VC Gap at €4.4bn in H1 2015

– Annualized Gap at €9.4bn – New Record High

– Late Stage Funding the Main Culprit

As in previous research we calculate Germany’s VC gap in relation to GDP to account for the size difference compared to the US.

Despite much talk about a German startup and VC boom – some might say ‘HYPE’ – we find that the gap versus US VC investments has increased further to EUR4.4bn in H1 2015. This gives an annualized shortfall of EUR9.4bn, up 27% on last year’s number of EUR7.4bn. Please note, that last year’s venture gap has been revised upwards by EUR0.3bn due to a change in included data points.

A strong increase in US late stage funding is in our view the main reason for Germany’s increased VC deficit. US late stage rounds have both risen in terms of number and volume. The strong increase in average funding volumes for US late stage VC rounds has already led to the creation of the term ‘Private IPO’, which we have explained in earlier RESEARCH.

A decline in Germany’s VC deficit can in our view be expected when global capital markets cool given US VC’s high correlation to the listed Tech sector.

Enough (sobering) news for today …

Stay tuned to corporate finance trends with our newsletter >> HERE