Record Quarter (likely) – Barkow Consulting FinTech Money Map Q1 Update

Peter Barkow – For Free Updates on Startups, VC & FinTech Sign Up >> HERE

FinTech VC: A Tale of Many Stories

The state of (global) FinTech VC has been subject to controversial debate for a while and we have continuously written about it. H2 2016 was weak globally and Q4 2016 was the weakest quarter in Germany for quite a while. Actually it was very, very weak.

Q1 2017 Globally – Probably Weak

There are not a lot of global data points out yet for the global sector in FY2017. A part from anecdotal evidence, there is FT Partners Q1 data, which indicates a very weak start to the year. According to their data global FinTech VC funding volume is down more than 50% yoy in Q1 2017. Number of deals is down 21%. But that is probably not yet enough to hang your hat on…

Q1 2017 Germany: A Super-Duper Quarter

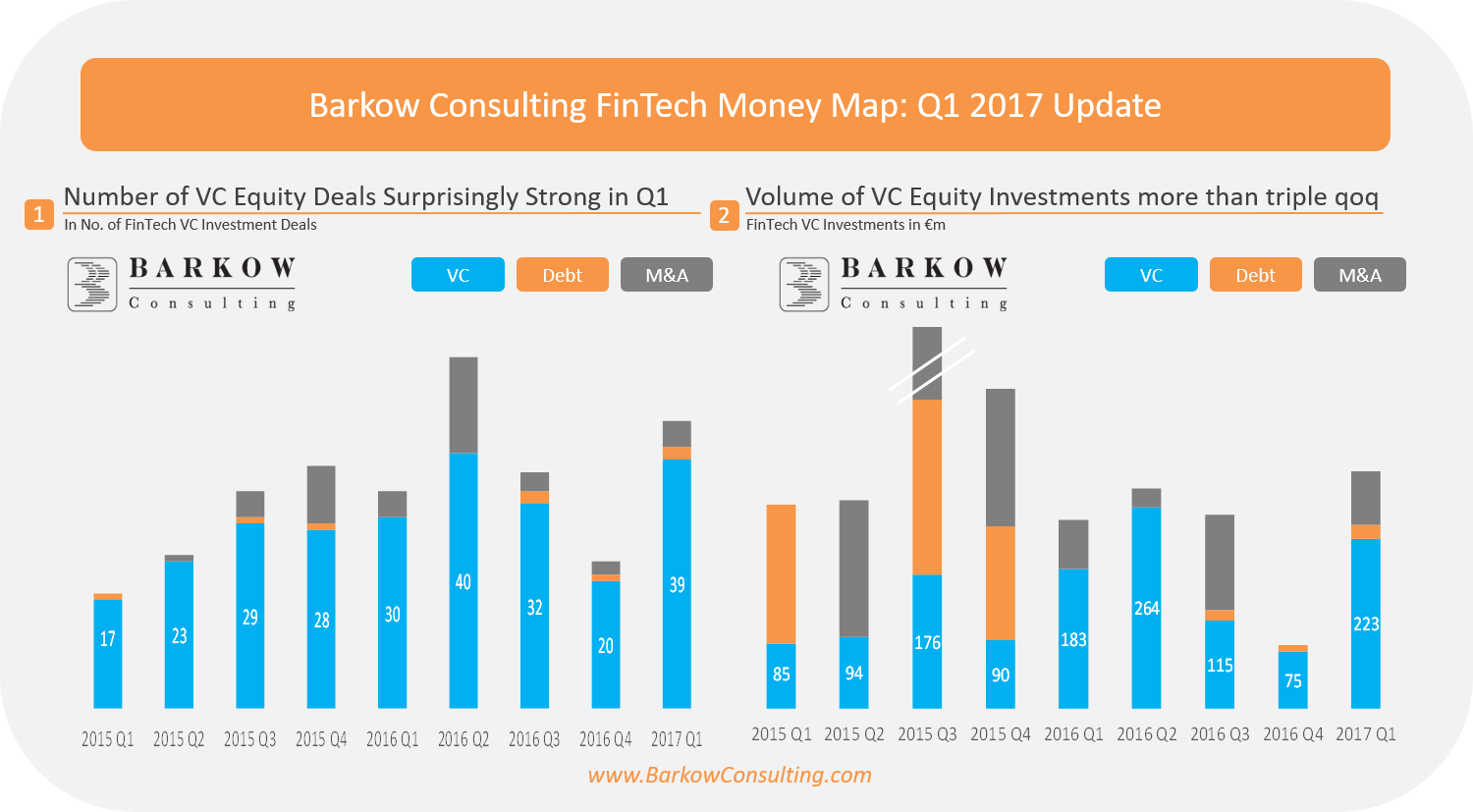

We were severly concerned about the state of FinTech VC in Germany three months ago, when we had to report a relatively weak quarter. Our hope was that a lot of deals would have been pushed into Q1. And this is exactly what happened:

- Number of equity deals came in at a very strong 39 almost double the previous quarters number

- This is just shy of the previous record in Q2 2016, for which we count 40 equity deals.

- Q1 2017 will very likely be a new record quarter, though its is currently still one deal short on the previous record. We have menioned before, that revisions are frequent in VC land, so our Q1 number will almost certainly increase. FYI: At the time of the FinTech Money Map Q2 2016 update, we recorded only 35 deals for the quarter in our database. Consequently, five deals have been added after quarter end.

- We count 10 large deals with a funding volume of €10m or more inlcluding one debt transaction in Q1 2017. This is a new record number, even ahead of Q2 2016, which had ‚only‘ 9.

- Equity funding volume came in at a strong €223m more than tripling qoq and up 21% yoy. Nontheless, below Q2 2016 with €264m

- Top 5 Deals: raisin, Solaris, Finleap, simplesurance, auxmoney