The Curse of Liquidity – Cost of Banks‘ Liquidity at the ECB

Peter Barkow | Sign Up For Our Newsletters >> HERE

– German Banks Currently Hold Excess Liquidity of €551bn

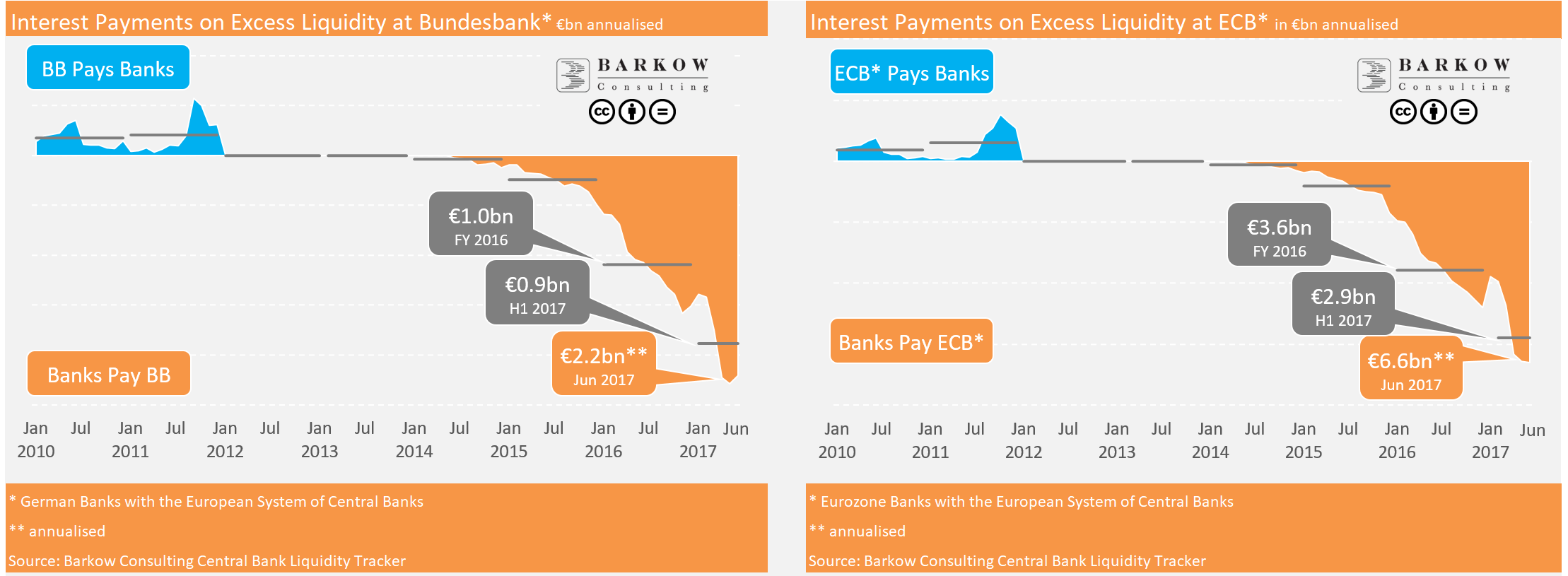

– Leading to Central Bank Charges of €2.2bn p.a.

– …Exceeding 8% of Bank Pretax Profits

Excess Liquidity at ECB Keeps Spiraling Up

Negative interest rates have triggered much talk about liquidity and funding costs for banks. The debate has heated up recently with more and more parties calling for an end of the ECB’s ultra-lose monetary policy.

One flip side of this is the cost burden of excess liquidity from commercial banks parked with central banks or the ECB. We have first quantified the impact at the end of last year publishing the result of our proprietary Barkow Consulting Central Bank Liquidity Tracker*. Our model monitors excess liquidity volumes and interest rate payments for the banking sector in Germany and the Eurozone.

We are now revisiting our model and updating for H1 2017 numbers.

We are well aware of the fact, that looking at the cost of excess liquidity only singles out just one of many interactions between commercial and central banks. There are, on the other hand various ways how banks currently benefit from ECB measures via low funding costs. So, the bottom line for banks will certainly look different.

Nevertheless, we consider it legitimate to put concrete numbers behind the current cost of excess liquidity or the sometimes so called liquidity tax.

Germany: Excess Liquidity Costs Exceed 8% of Pretax Profits

In June 2017 all German banks parked €551bn at Deutsche Bundesbank/ECB. This is just 4% shy of the record number from May 2017.

German banks paid interest charges of €0.9bn in H1 2017 alone, falling just marginally behind the €1bn for all of 2016. Annualising June 2017 leads of charges of €2.2bn for 2017 which is more than 2x the year ago number. It also corresponds to 8.3% of German banks’ pretax profits of €26.5bn in 2015 (most recently available data) or 9% of the three year average pretax profit of €24.5bn. Presumably the inclusion of not yet available 2016 profit figures will not change the picture significantly.

Eurozone: Excess Liquidity Costs Reach €6.6bn

Eurozone banks held a record €1.6tn of excess liquidity with the ECB in June 2017. This caused excess liquidity costs of €2.9bn for H1 2017. Annualising June 2017 the figure even climbs to €6.6bn.

*) Our model calculates interest payments by applying ECB deposit facility rates on excess liquidity held with the central bank (deposit facility, current account balance minus minimum reserve). Our model relies on data from Deutsche Bundesbank and ECB only.