Global FinTech VC 2016 – Sneak Preview

Peter Barkow – For Free Updates on VC & FinTech Sign Up >> HERE

Venture Capital Data – Beauty of Diversity?

Shortly after the end of each quarter venture capital statistics are released. There are various sources for VC data, so over a relatively short period of time many data points come out. Due to various reasons these data points tend to vary a lot. The issue of differing data points gets even more challenging, when diving deeper into specific regions or verticals or even both (e.g. FinTech Venture Capital in Germany).

At Barkow Consulting, we look at all available data points in order to get an accurate macro picture of the state of the VC industry, which we then blend with our own industry expertise. In addition, we prefer deltas of individual data sources (e.g. up XX% qoq or yoy) to absolute values.

Nevertheless, each quarter starts with a first data print, which sort of paves the way for future and ongoing discussions.

Global FinTech VC in 2016 – The 1st Print

Global FinTech VC is of particular interest at present, with some sources having observed a slowdown recently after exponential growth in previous years.

Therefore, 1st data points for FY2016 were eagerly awaited, which have now been released by FT Partners.

According to our understanding FT Partners definition of FinTech is relatively broad so their investment volume tends to come in at the very high end of the range of competing data points. Also FT Partners speaks of Financing Volume, which again might be broader than VC.

First take of FinTech VC in 2016:

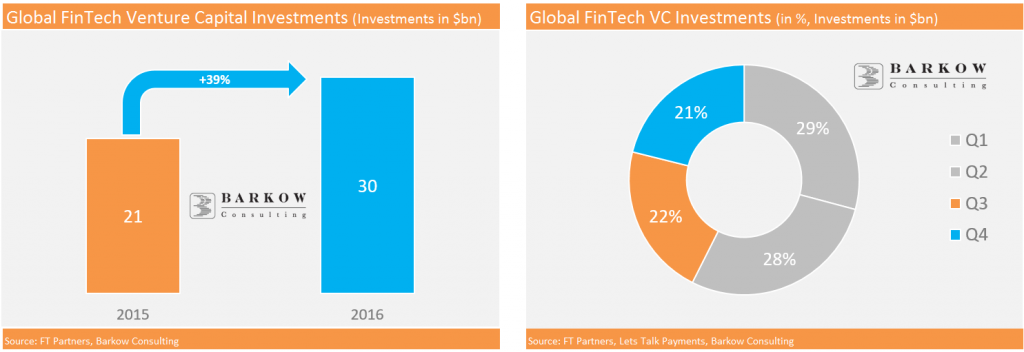

- FinTech VC reached $30bn*, up 39% yoy

- FinTech VC deals increased by 5% to 1.5k

- Q1 was the strongest quarter of the year with 29% investment volume share

- Investment volumes have been decreasing quarter by quarter in 2016

- Therefore, Q4 was the slowest quarter of the year with 21% share so far. Be aware that Q4 is generally a weak VC quarter, In addition, numbers tend to get revised upwards significantly. Q4 is thererfore likely to surpass Q3 on final numbers.

* Let’s Talk Payments has even published $36bn citing FT Partners as a source

Conclusions So Far

Based on FT Partners data, FY2016 was a new record year for FinTech VC by a wide margin. But H2 showed a significant slowdown as well. The latter seems to be stabilising or even reversing in Q4, however.

This was the 1st of various releases to come, so results need to be treated with care. Therefore, we will continue to watch the space for additional FinTech VC data points in coming days and weeks in order to get a clearer picture of how FinTech VC is faring.

Peter Barkow – For Free Updates on VC & FinTech Sign Up >> HERE