How Profitable Are German Banks Really?

For Free Updates Sign Up to Our Newsletters >> HERE

Profits of German Banks Are Shockingly Low, Right? Well, We Are Not So Sure…

Common wisdom suggests that profitability of the German banking system is surprisingly poor. And agreed, a lot of German banks are currently not really flush with profits.

It Is Very Hard to Analyse the Diverse German Banking Sector

Finding out about the profitability of the German banking system is, however, much harder than usually one would think. One major obstacle to overcome is the dominant market share of unlisted banks. Whereas for other countries covering quarterly or annual reports of major listed banks is often sufficient to monitor average banking systems profitability (and strength), in Germany, however, it is not. Here, the unlisted sector represents substantially more than half of the banking system comprising still in excess of 1.300 of notoriously low-key savings and cooperative banks. The tremendous fragmentation of the German banking system, which is rather unique in Europe, leads to the necessity to cover and analyse a lot more financial reports compared to other countries. But, even apart from the sheer number of savings and cooperative banks, there are further time-consuming difficulties:

- Most savings and cooperative banks only disclose numbers according to German GAAP (HGB)

- Most savings or cooperative banks only show results at holding level and NOT on a consolidated or group basis

- Most savings and cooperative banks do not report quarterly or interim results

Aggregated Financial Data Sets Are Crucial for Research

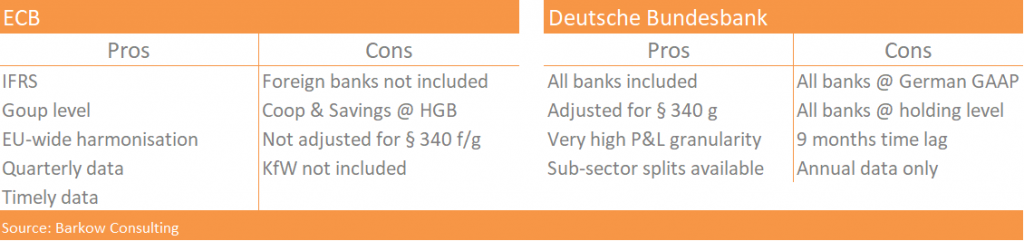

Due to the obstacles described above analysts crucially depend on aggregated data sets. As a research house, we would like to highlight two basically reliable data sources, which are of highest importance to our analytical work:

Deutsche Bundesbank

Deutsche Bundesbank publishes data on the German banking systems profitability once a year. The data set is very granular covering the most important P&L items for various subsectors (commercial, savings, cooperative, state banks etc.).

ECB

The ECB publishes key

profitability items for banking systems of all Eurozone countries on a

quarterly basis.

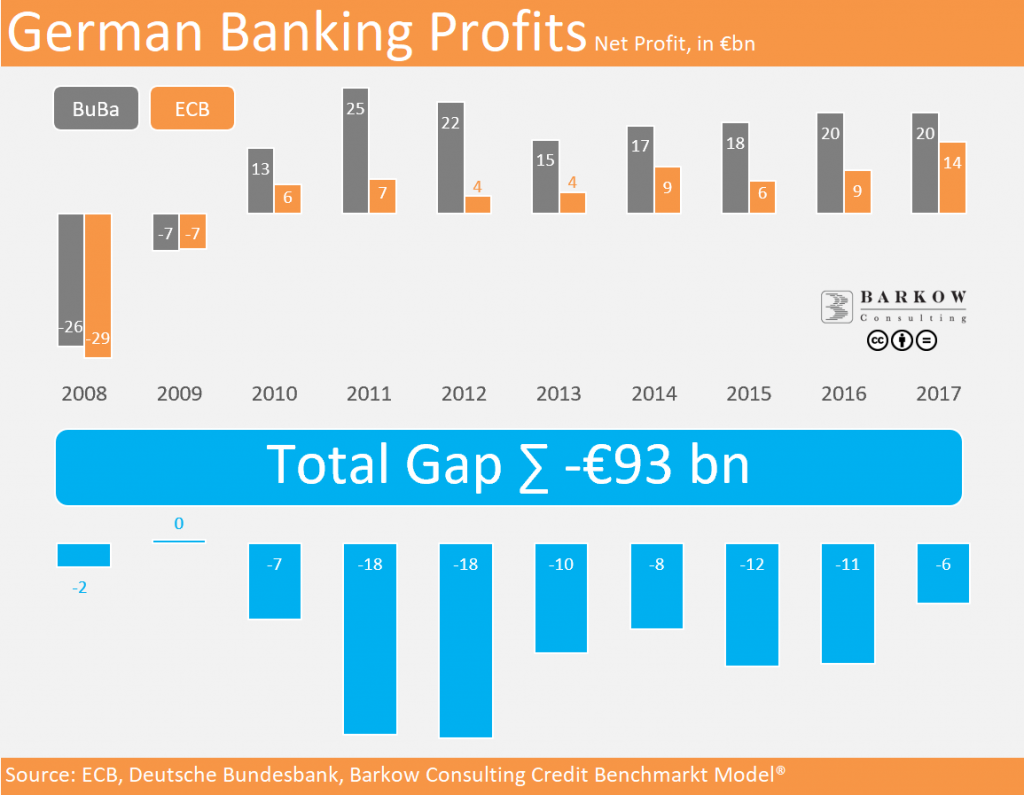

A €90bn+ Profit Gap Between ECB and Bundesbank

You would assume the above data sets should be sufficient to provide for a comprehensive overview of the German banking system and precise view on its profitability (and strength). Well, you might be wrong…

Already, at face value there is a cumulative profit or net income gap in excess of €90bn between Deutsche Bundesbank and ECB data for the last ten years. In addition, according to Bundesbank figures there was literally no profit growth in 2017. However, even more surprisingly ECB numbers show a huge profitability jump of 65% yoy to an all time high since the outbreak of the financial crisis. The latter is hard to reconcile with our observations of the German banking system. Also, we haven’t met a lot of CEOs in banking bragging about their high profits…

Our Issues with Bundesbank and ECB Profit Data

In short: At least one of the above data sets obviously is useless, maybe even both.

Below we briefly summarise our issues with Bundesbank and ECB data:

Bundesbank Focuses on German GAAP

As we said Bundesbank data is very comprehensive (number of institutions, P&L- and sub-sector-coverage). Unfortunately, the data is published only annually with a substantial time-lag of nine months. And this is not the only challenge to cope with.

Bundesbank is entirely dependent on German GAAP (HGB) data, which we find rather problematic. German GAAP financial reports are rather opaque and simply not too informative: Especially large and complex banking groups are almost impossible to rate from the outside. Also, most international analysts are not familiar with German GAAP.

One major distorting element of German GAAP is the possibility to build up general banking reserves (§ 340f and § 340g HGB). They are considered an expense item under German GAAP, but are part of profit under IFRS and even for German tax purposes. However, Deutsche Bundesbank is adjusting for §340g reserves, which leads to more realistic profit numbers. §340f reserves are not accounted for by Bundesbank as they are literally invisible from financial reports. Nevertheless, Bundesbank sectoral profits are substantially higher than respective numbers disclosed by associations of the savings banks and the cooperative banking sector.

Furthermore, all

other remaining differences between HGB and IFRS are unfortunately not

considered and adjusted for by Deutsche Bundesbank.

ECB Does Not Consider Large Parts of German Banks Profits

ECB is disclosing main P&L lines of Eurozone banking systems on a timely and quarterly basis. ECB is using IFRS numbers for German banks, if available. But for cooperative and savings banks ECB has to rely on German GAAP numbers. As we understand, however, ECB tries to map German GAAP into IFRS to a certain degree. In other words, banks need to report main balance sheet items according to IFRS. This does, however, apparently not include §§ 340f/g at P&L-level. In addition, ECB data excludes German banks with a parent bank in another Eurozone country. Given the weight of German banks owned by Eurozone foreigners (e.g. Unicredit/HVB, ING Germany, targobank and Santander Germany) a meaningful part of the German banking system is simply missing in ECB numbers. Furthermore, ECB does also not consider state owned special purpose lender KfW.

The aforementioned three issues alone must lead to a massive underrepresentation of German banking profits.

Revision, Harmonisation and/or Reconciliation Needed

As we describe above, both data sets are confusing and need revision and harmonization. The data is coming from two of the most important institutions of the European banking sector. They have an excellent reputation regarding data quality and accuracy. Therefore, their data sets are probably relied upon by most market participants and are simply taken at face value.

As both data sets are likely understating the strength (read profits) of the German banking system to some extent, there are potentially numerous questionable implications at financial and even political level, particularly on regulation. These could also include negative impacts on credit and equity ratings, which in turn might lead to higher cost of capital for certain German banks or banking sectors.

What Bundesbank and ECB Should Specifically Do Now?

We think the two institutions should do the following:

- Use IFRS numbers as much as possible

- Harmonise the two data sets

- If a full harmonisation of data is not possible, an extensive reconciliation of profits would be a minimum

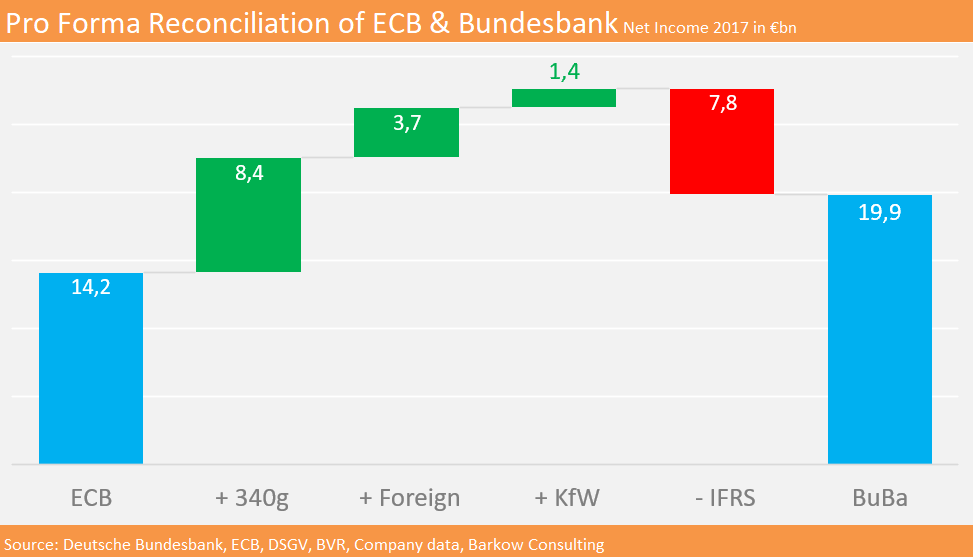

A 1st Attempt of Reconciling Bundesbank and ECB profits

Based on the datasets available and with all limitations described above, we are presenting a first attempt at reconciling profit numbers on a Pro Forma basis. Again, we would like to highlight limited information available and would urge readers to only consider our Pro Forma calculations as a rather crude directional estimate rather than exact science.

Our pro forma reconciliation of ECB and Bundesbank numbers for Germany in 2017 looks like this:

- We start off with net income of €14.2bn reported by ECB

- We then add newly build § 340g reserves from savings and cooperative banks, which we estimate at €8.4bn

- We then increase profits of German banks with a Eurozone banking parent company by an estimated €3.7bn based on financial reports of leading players

- We add KfW profits of €1.4bn

- So far, we come up with a total of €27.7bn

- The remaining gap of a (negative) €7.8bn is then considered as the remaining IFRS related difference/impact by us to bring our adjusted ECB profit number in line with Bundesbank’s figures of €19.9bn. This is admittedly a crude approach as the figure is a miscellaneous item containing all remaining differences, wherever they might come from.

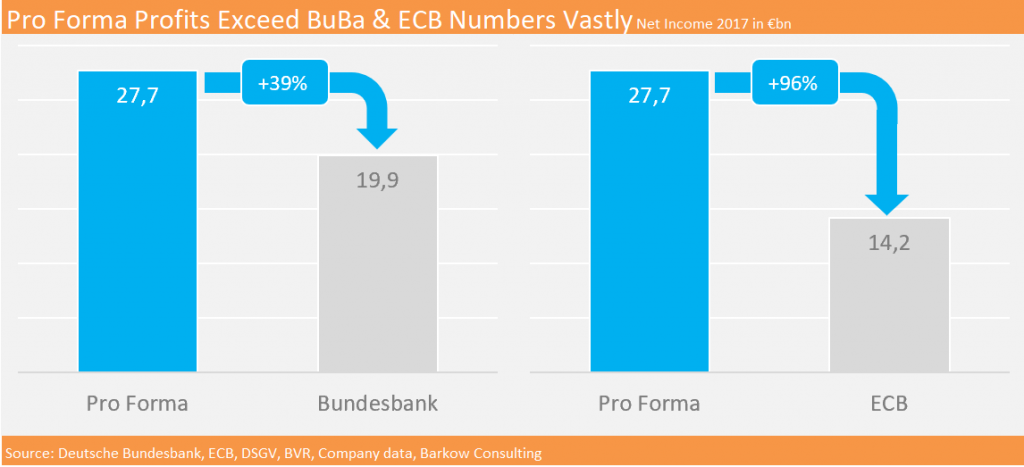

Pro forma Profit Is Almost 2x ECB and almost 40% higher than Bundesbank

We already said, that both Bundesbank and ECB very likely underestimate the underlying profitability of the German banking system. Using our pro forma calculation above, we would argue that taking the ECB profit number of €14.2 and then adding §340g, KfW and foreign parts of the German banking system is a rough but best approximation we can get to.

The above approach leads to a pro forma profit of €27.7bn. Our pro forma number could even be conservative as it does not include any presumably positive IFRS impact except reclassifying §340g reserves.

But even the in our mind conservative pro forma profit estimate of €27.7bn is almost 40% higher than the equivalent from Bundesbank and almost twice ECB’s profit number.

To make things clear. This is definitely a – too – HUGE difference to live with. During my career as an equity research analyst I cannot recall a single time, that I found almost of 40% of extra profit buried in company accounts let alone almost 100%…

This in itself is enough reason to revise and harmonize the two data sets as described above. There is plenty of room for improvement as it seems. In any case, we would consider it meaningful to find out specifically, where the problem (or in this case profitability of German banks) lies.

We hope, that with this research note we will eventually start a debate, that will lead to better and more meaningful data in the end.