No New Records… | Real Estate News

Peter Barkow – For Free Updates on Real Estate sign up >> HERE

We have just published the Q3 edition of our Real Estate News looking at Q2 2017 net capital inflows into German indirect property investment vehicles:

- Listed Real Estate: Slow

- Public Open-End Funds: Slowing

- Closed-End Funds: Increasing

The complete newsletter can be downloaded …

Summary

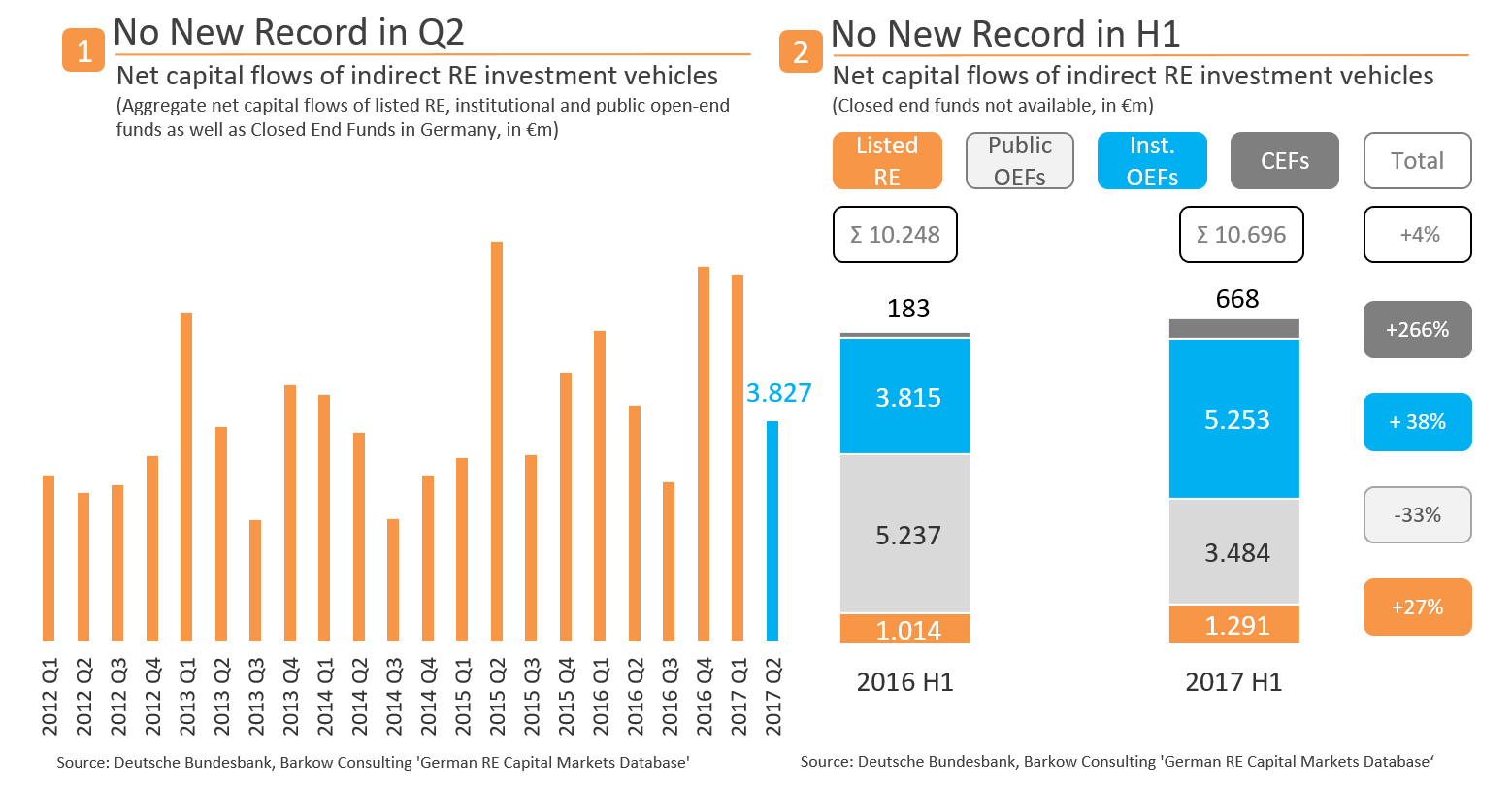

In Q2 2017 indirect real estate vehicles accounted for net capital inflows of €3.8bn down 14% yoy. H1 2017 came in at €10.7bn increasing by 4% yoy, but 2% shy of the post crisis record H1 in 2015. We estimate the all time high for H1 at around €14bn in 2003, almost entirely driven by public OEFs at the time.

(Chart 1 & 2)

Listed real estate iinflows were slow again in Q2 at € 0.5bn. This brings H1 2017 to €1.3bn representing an increase of 27% yoy. Nonetheless, €0.3bn of Q2 inflows consist of ‘dividends’ paid in stock by Vonovia and hence are no ‘ordinary’ capital markets transaction.

(Chart 2 & 3)

Net inflows into public open ended funds came in at €1.2bn in Q2 2017. This down 50% on the year ago, but the number needs to be seen in the context of many funds being closed for new business due to lack of investment opportunities. Some new funds have been launched recently, however. H1 2017 is down 33% yoy to €3.5bn.

(Chart 2 & 4)