FinTech VC – Germany to Overtake UK in 2017?

Peter Barkow – For Free Updates on VC & FinTech Sign Up >> HERE

Venture Capital Used to Prove Success of Ecosystems

The startup world is inherently intransparent and generally lacks statistics, obvious for any young or new market. Thus, measures such as startup revenues, number of startups, number of employees etc. are usually not handy and/or not comparable across cities. So how do you prove the success of a startup ecosystem

This is where venture capital comes into play. The logic behind taking VC as a measure for startup success is the following:

- VC statistics are readily available, often confusing or even contradictory, but available nonetheless

- ‘If a city attracts most VC dollars, it likely has the most successful startup ecosystem too’

We have already written at length about the challenges of comparing VC volumes across regions at face value:

- Inconsistent data sources

- Currency fluctuations

- Different business and capital markets cycles

- No referencing to the size of a region (most commonly VC is related to GDP)

- And many more

But let’s forget about the above for a second.

„Germany has overtaken UK?!“

In Germany, we continue to read and hear statements such as:

“Berlin has overtaken London in Venture Capital funding.”

„There is more VC invested in Germany than in the UK.“

These statements can often be attributed to politicians, but they are not limited to them. These statements are also frequently related to FinTech VC.

FinTech VC – Germany right at the heels of the UK

In a post-factual world we have decided to lend a hand and put this to the test.

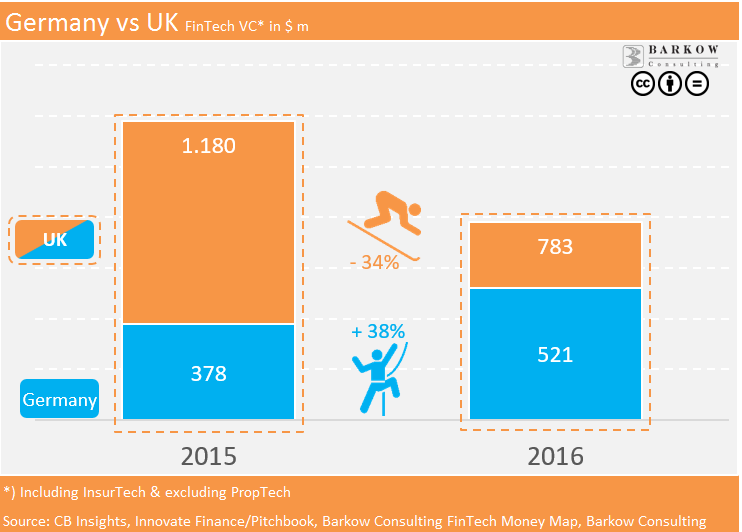

The below chart illustrates FinTech VC trends in Germany and the UK for 2015/16 and shows the following results.

- The UK was 50% ahead of Germany in 2016

- The countries follow very different growth trends: UK FinTech investments are declining rapidly, whereas Germany is increasing.

- Brexit was a double negative for the UK slowing investments and leading to a lower US $ value due to a collapsing British pound.

- Germany is potentially a Brexit beneficiary with VCs reallocating their regional spendings to the continent. This is too early to say, though.

- Most importantly: The FinTech VC gap is closing rapidly.

Should trends continue, Germany could overtake UK in 2017!

So maybe some people are just ahead of the time…

For Free Updates on VC & FinTech Sign Up >> HERE