1st Fund Outflows in Almost 10 Years

Dr. Wolfgang Schnorr | Sign Up For Our Newsletters >> HERE

How is Covid19 Impacting Savings or Money Flows? Still Grasping for Straws…

With the Covid19 pandemic still unfolding around the globe, we are continuously grasping for for hard facts about the impact on financial money flows. Substantial measures to contain the virus in Europe have only started at the end of the first quarter. Therefore, their consequences for financial money flows can only bee observed in data points from March/April or later. As official data usually comes out with some delay, we are only starting right now to patch together the full picture.

Covid19 Leads to 1st Fund Outflows in almost 10 Years

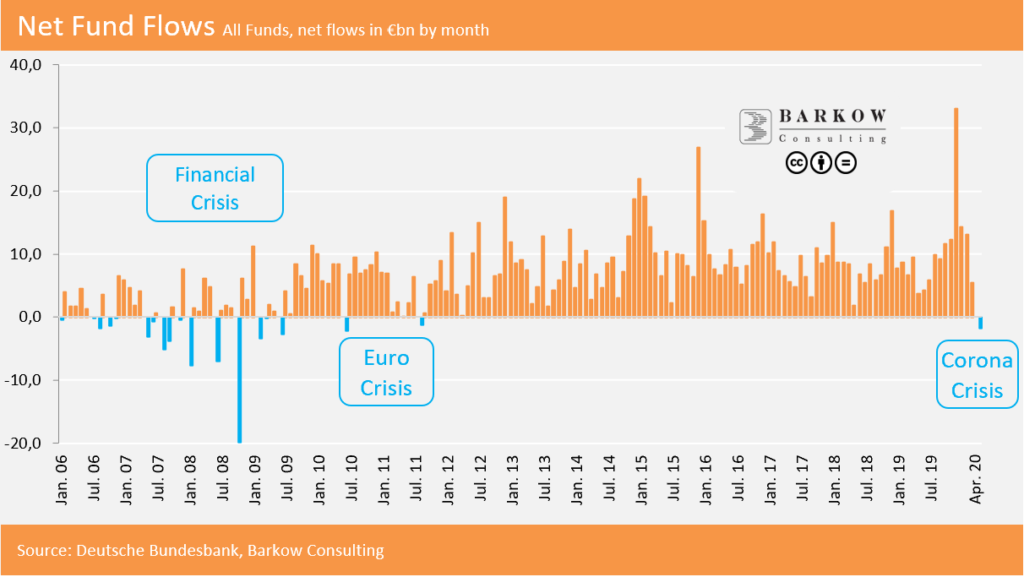

One area, where data is already available for March and largely for April is open ended fund flows for the German market. Below, we show the monthly development for all funds (public and institutional) for the last 14+ years.

It is fairly obvious that outflows are a rare phenomenon only happening during times of crisis. April 2020 was the first month with money outflows for almost 10 years totaling €1.8bn. Last outflows were seen in August 2011 during the height of the Euro crisis.

Our chart also shows much larger outflows so far only during the financial crisis between May 2007 and June 2009 reaching their peak of roughly €20bn in October 2008. So, there might be room for further decline in the months to come.

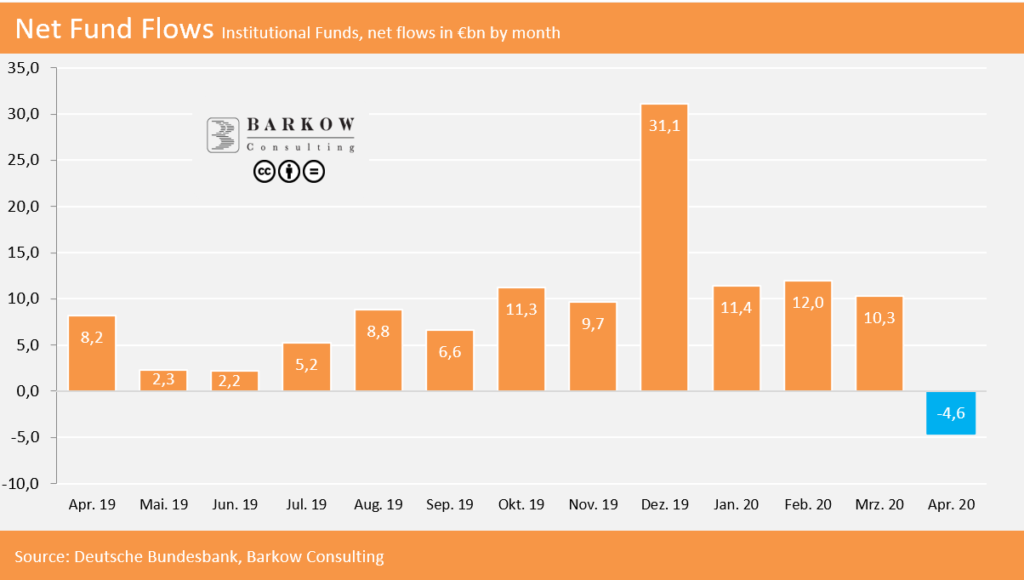

Institutional Funds to Blame

As stated above outflows for public and institutional totaled €1.8bn in April. During the same period public funds only recorded inflows of 2.8bn. Therefore, by pure arithmetic institutional funds must have had outflows of €4.6bn, a strong reversal from inflows of €10bn or more in each of the preceding six months. Individual data for institutional funds and sub-categories are still missing.

Worse to Come? Maybe not…

Comparing the estimated GDP impact of Covid19 with the financial crisis (2008/09), would suggest that major fund outflows are ahead. This might, however, be a to simple conclusion. Stock markets, in particular, are shrugging off the corona virus with surprising ease. Against the backdrop of unprecedented fiscal and monetary action they have recovered strongly in recent weeks. Maybe, fund flows will do the same.