2019: InsurTechs Lead German FinTech VC for 1st Time

Peter Barkow – For Free Updates on Startups, VC & FinTech Sign Up >> HERE

German FinTech VC 2019

- InsurTechs Most Successfull Category for 1st Time

- Challenger Banks Drive Finance Aggretation Startups to No.2

- PropTech Loses Top Spot, Drops to No.5

German FinTech VC 2019 Hits Fresh Record High

German FinTech VC 2019

reached €1.7bn increasing 44% yoy and hitting a fresh record. Please check for

details

HERE.

Category Rotation was intense in 2019 with the rankings of Top5 categories having literally turned upside down. Therefore, we decided to take a more detailed look below!

Challenger Banks Drive Success of Finance Aggregation Category

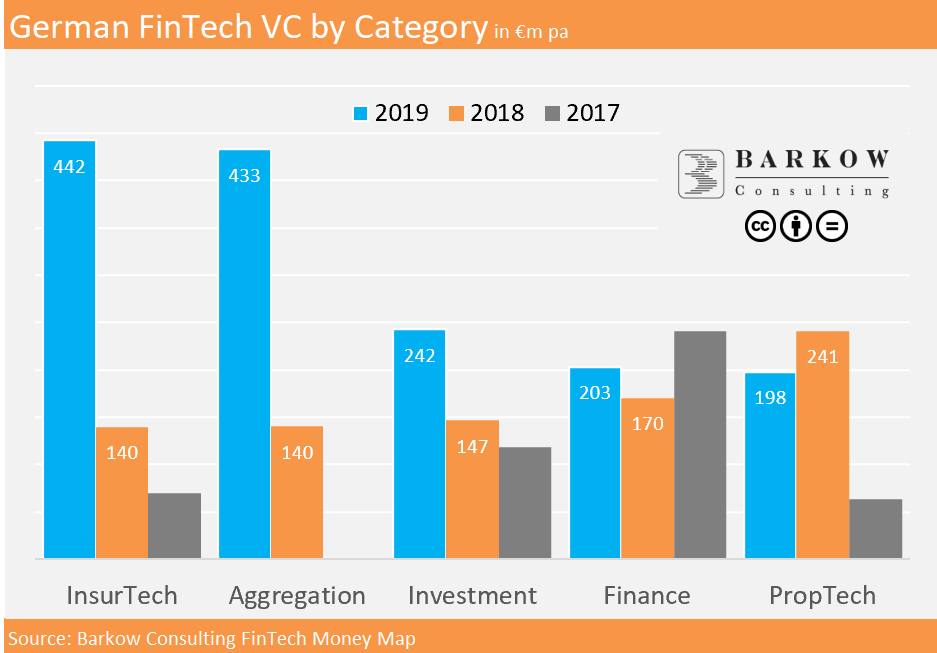

It comes of little surprise, that the Finance Aggregation category, that also includes challenger banks such as N26, Penta or tomorrow rose significantly in importance. It more than doubled its venture capital share from 12% 2018 to 25.5%. German Finance Aggregation VC 2019 totaled €433m trebling yoy.

InsurTech Most Successful Category For the 1st Time

Nevertheless, German InsurTech startups were even more successful reaching €442m 2019, up 216% from €140m a year ago. Thus, InsurTech accounted for 26.2% of German FinTech VC 2019 making it the most successful Geman FinTech VC category for the first time.

PropTech Lost Top Spot, Dropped to Rank No. 5

PropTech startups had a less favourable 2019 losing its top spot from 2018 with €241m VC in the year. The PropTech category was still able to attract €198m 2019, which represents 11.7% of total German FinTech VC. With that, however, PropTech dropped to rank number 5.