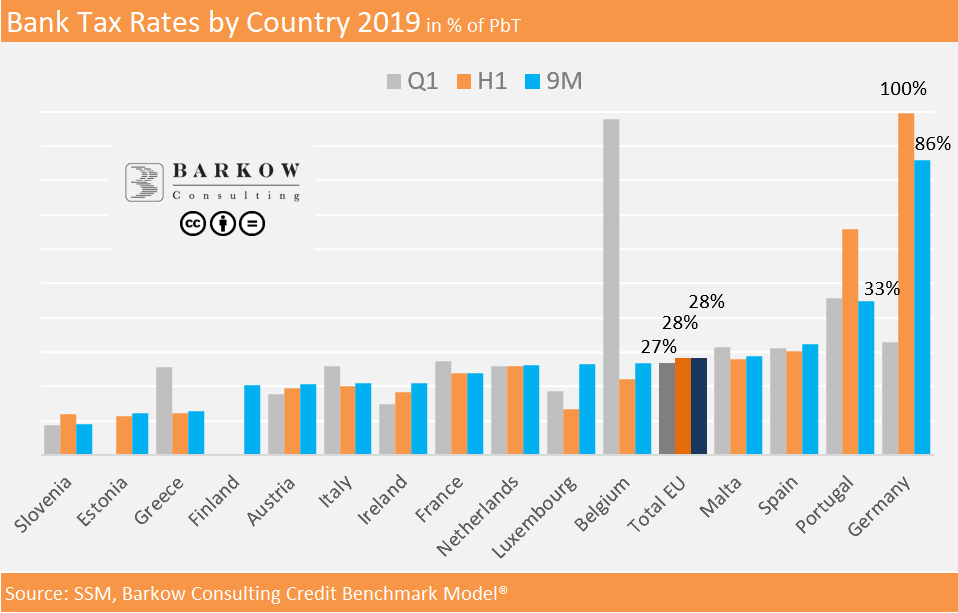

Working for Taxes Only? German Banks’ Tax Rate Hits 100% in 2019

Dr. Wolfgang Schnorr, Peter Barkow – Sign Up For Our Newsletters >> HERE

German Banking Statistics: When Profit Does Not Equal Profit…

We have written at length about confusing German banking profit data from Bundesbank and ECB (HERE, HERE and HERE) resulting in our view that both data sets are in need of reform. We have also adressed this directly with ECB and Deutsche Bundesbank. Unfortunately, Dr. Weidmann did not agree and our letter to the ECB has not yet produced a response. So, as it seems, for the time being we will have to live with the data as it is.

So far we have not written about a third data set produced by the Single Supervisory Mechanism, which we would crudely ascribe to the ECB as well. The main reason was, that it has not caught much media attention in the past. In addition, it focuses on (large) banks supervised by the SSM only. This leads to a changing sample over time making historical comparisons even more challenging compared to the above mentioned data sets.

Media attention, however, has changed with the release of Q3 2019 data and numerous outlets reported about German banks generating the same profit as Greek banks for 9M 2019. This is when we decided to take a more detailed look…

Yes, 9M 2019 Net Profit for German Banks Equals Greece’

Indeed, SSM 9M 2019 net profit for German banks came

in at €668m; a shockingly low number for Europe’s largest economy and roughly

in line with Greek banks producing €656m.

This is, however, only part of the story:

- H1 2019 was even worse; a lot worse we would say. German banks were barely break even with a profit of only €9m (no, we haven’t confused millions and billions…). This was even lower than Greek banks at €404m.

- Nonetheless, German banks are not producing less profits than their Greek counterparts. If we turn our view to pre tax profit the picture changes substantially. All of a sudden German banks generate 9M 2019 PbT of €4.8bn. This is still much too low for German banks, but more than 5x Greek banks PbT.

German Banks’ Profit Is Fully Eaten Up by Taxes

Putting 1. and 2. together it becomes fairly obvious that there is something severely wrong with German banks’ 2019 tax rates . Tax rate was 100% for H12019, still standing at 86% at 9M stage. We all know, that Germany is a high tax country, but these rates are out of kilter without a doubt. So what could be the reason?

Non Tax Deductible Charges Must Have Been High – General Banking Provisions Likely Not to Blame

Obviously unusually high non tax deductible charges are to blame. The first thing that springs to mind is the build up of general banking reserves acc. to 340f/g HGB for which German banks are notorious for. Under German GAAP these are non tax deductible and reduce PbT and increase tax rates. Larger German banks report, however, IFRS data or at least IFRS mapped data to the SSM. Under IFRS general banking provisions are part of profit and do not distort tax rates. In addition, the tax rate bump came fairly sudden in Q2 2019. The build up of general banking reverse is normally not that volatile. It is therefore highly unlikely, that general banking provisions are causing high tax rates in the second and third quarter.

Restructuring Charges Might Be the Culprit

Almost by definition, restructuring charges hit the P&L in a bumpy fashion.

In case of provisions for restructuring charges, it is also possible or even likely that they are not tax deductible in the very period they are build. They become, however, tax relevant, when they are used. So the disconnection between commercial and fiscal balance sheets reverses over time. This is precisely the case for building up deferred tax assets under IFRS, which would lower and smoothen the tax rate. Over the years we have, however, observed that deferred taxes are largely build in Q4 so we might see a positive impact on next quarter’s tax rate. We will make sure to revisit German banks’ tax rate then and keep you posted.